stock option tax calculator uk

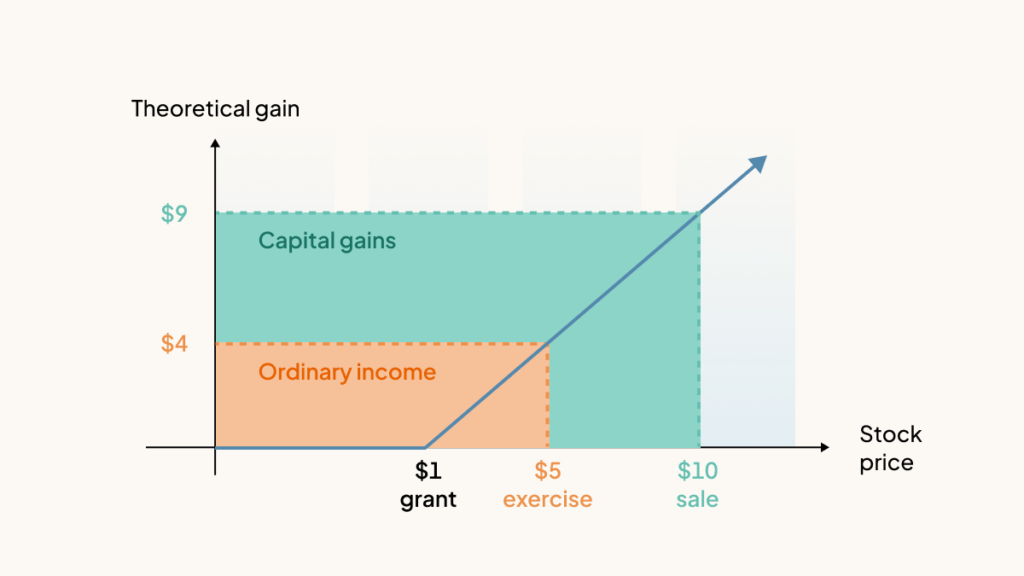

If you exercise an option to acquire vested shares in an unapproved share. Taxes for Non-Qualified Stock Options.

2021 Capital Gains Tax Rates In Europe Tax Foundation

When the option is exercised the option gain is subject to income tax up to.

. Short-term and long-term capital gains tax. In particular stock trading tax in the UK is more straightforward. Helping You Turn Burden into Opportunity.

Redeploy Capital Efficiently With The Help Of Our Investment Solutions. The rate of CGT on the disposal of the shares in the UK can be as low as 10 per cent. The Stock Option Plan specifies the employees or class of employees eligible.

Exercising your non-qualified stock. Access Our Full Suite of Innovative Award-Winning Trading Platforms Built for Traders. NSO Tax Occasion 1 - At Exercise.

The Stock Option Plan specifies the total number of shares in the option pool. This permalink creates a unique url for this online. The strike price of 2500 1000 250 Taxes.

Year-End Planning Resources To Help You Reallocate Capital For Tax Loss Harvesting. Discover the Power of thinkorswim Today. Nonqualified Stock Option NSO Tax Calculator.

The same property or stock if sold within a year. You can deduct certain costs of buying or selling your shares from your gain. This calculator illustrates the tax benefits of exercising your stock options before IPO.

On this page is an Incentive Stock Options or ISO calculator. When you exercise an NSO you pay the. Call Moss Adams Today.

How much are your stock options worth. When you exercise youll pay. Stock Options Restricted Stock Grants and Internal Tender Offers.

Input details about your.

Here Are 4 Big Tax Mistakes To Avoid After Stock Option Moves

How Are Stock Options Taxed Carta

Crypto Staking Calculator For 2022 Eth And Others Haru

How Are Start Ups Taxed Forbes Advisor India

Capital Gains Tax Calculator Taxscouts

11 Best Crypto Tax Software Solutions 2022 Reviews Fortunly

How To Selling Stock Options When You Re In The Highest Tax Bracket

Stock Options Vs Rsus What S The Difference Smartasset

How Are Options Taxed Retirement Plan Services

2022 Corporate Tax Rates In Europe Tax Foundation

How To Deduct Stock Losses From Your Taxes Bankrate

Secfi Stock Option Tax Calculator

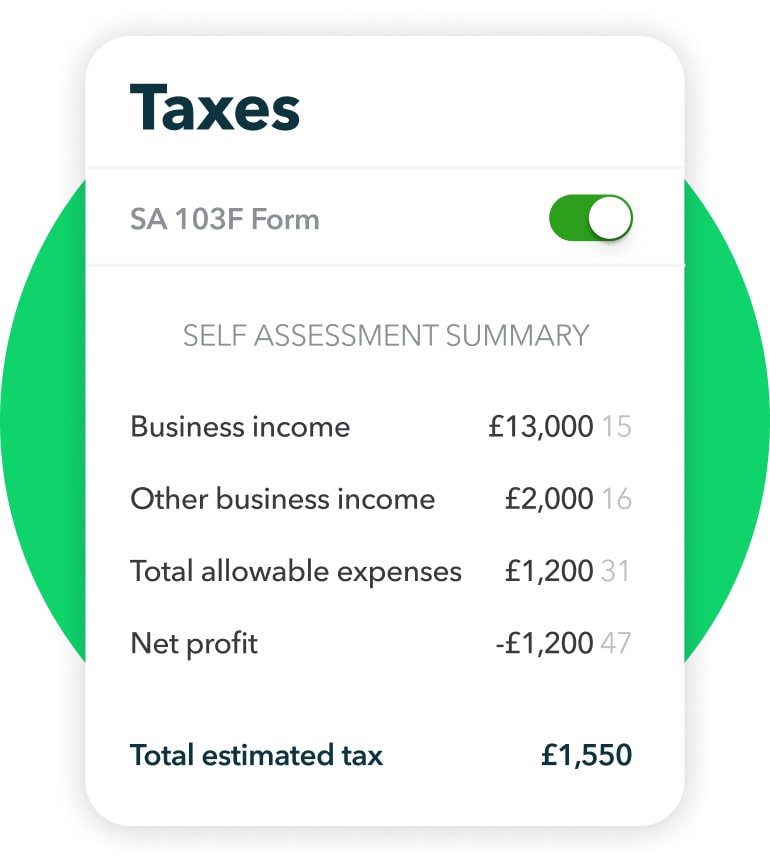

Hmrc Self Assessment Self Assessment Quickbooks Uk

Crypto Tax Uk Ultimate Guide 2022 Koinly

Dentons Upcoming Changes To The Taxation Of Certain Employee Stock Options

Tax Calculator Uk Tax Calculators

Learn About Emi Share Option Schemes Vestd

How To Calculate Capital Gain Tax On Shares In The Uk Eqvista