iowa inheritance tax rates 2020

The rate is determined by the amount of the inheritance received and range from anywhere between 5 and 15. If the net value of the decedents estate is less than 25000 then no tax is.

The Effects Of Taxes On Wealth Inequality In Artificial Chemistry Models Of Economic Activity Plos One

The hope is to convince more retirees to choose Iowa as their state of residence.

. The repeal of the Iowa inheritance tax follows the trend across the country to reduce such taxes. Register for a Permit. The Iowa inheritance tax rate varies depending on their relationship of the inheritors to the deceased person.

If the net estate of the decedent found on line 5 of IA 706 is less than 25000 the tax is zero. The applicable tax rates will be reduced an additional 20 for each of the following three years. States that collect an inheritance tax as of 2020 are Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania.

IA 8864 Biodiesel Blended Fuel Tax Credit 41-149. Learn About Property Tax. A bigger difference between the two states is how the exemptions to the tax work.

Read more about IA 8864 Biodiesel Blended Fuel Tax. It has an inheritance tax with a top tax rate of 18. Payments under a qualified plan made to the estate of the decedent are exempt from Iowa inheritance tax.

Pre-2021 taxiowagov 60-061 01032022 Pursuant to Iowa Code chapter 450 the tax rates are as follows. Property passing to parents grandparents great. Content updated daily for iowa inheritance tax.

In 2021 Iowa decided to repeal its inheritance tax by the year 2025. Especially if your total assets approach 5 million or more the possibility of being subject to estate tax rates as high as 40 percent can be a compelling reason to consider land. Read more about Inheritance Tax Rates Schedule.

Land protection may reduce the value of your land which in turn reduces the value of your estate and may reduce your federal estate tax and state inheritance tax. There are a number of categories of inheritor for the inheritance tax but only two are relevant for individuals. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

What is the inheritance tax 2020. 2021 but before January 1 2022 the applicable tax rates listed in Iowa Code section 450101-4 are reduced by 20. Report Fraud.

The Tax Cuts and Jobs Act TCJA doubled the estate tax exemption to 1118 million for singles and 2236 million for married couples but only for 2018 through 2025. If the net estate of the decedent found on line 5 of IA 706 is less than 25000 the tax is zero. A summary of the different categories is as follows.

Learn About Sales. Inheritance Tax Rates Schedule. See the Iowa Inheritance Tax Rate Schedule Form 60-061 090611.

Iowa Inheritance Tax Rates. Ad Access Tax Forms. If you have questions or need assistance concerning inheritance taxes please reach out to our office at 515 225-1100 or through our contact page.

The tax clearance releases the property from the inheritance tax lien and permits the estate to be closed. See IA 706 instructions. Ad Looking for iowa inheritance tax.

For deaths in 2021-2024 Iowa will reduce the estate tax rate by an additional 20 each year until the tax is fully phased out. In the meantime there is a phase-out period before the tax completely disappears. Change or Cancel a Permit.

Adopted and Filed Rules. 2022 taxiowagov 60-064 05312022 Pursuant to Iowa Code chapter 450 the tax rates are as follows. Complete Edit or Print Tax Forms Instantly.

See IA 706 instructions. Iowa does not have a gift tax. What is Iowa inheritance tax.

Does Iowa have an inheritance tax. Track or File Rent Reimbursement. The exemption level is indexed for inflation reaching 114 million in 2019 and 1158 million in 2020 and twice those amounts for married couples.

See Iowa Code section 4504. How do I avoid inheritance tax in Iowa. File a W-2 or 1099.

Subject to Iowa inheritance tax. The federal gift tax has a 15000 per year exemption for each gift recipient in 2021 and 16000 in 2022. If you wish to avoid an inheritance tax you can ensure that the net estate is valued at less than 25000.

Each has its own laws dictating who is exempt from the tax who will have to pay it and how much theyll have to pay. It is most common for Iowa inheritance tax to be due when estate shares are left to non-lineal relatives of the decedent such as brothers sisters nieces nephews aunts uncles or cousins. On June 23 2021.

Iowa Inheritance Tax Rates. Iowa does have an inheritance tax which beneficiaries are responsible for paying on their inheritance. Estate tax rate ranges from.

Even if no tax is due a return may still be required to be filed. Up to 25 cash back 7031 Koll Center Pkwy Pleasanton CA 94566. Iowa is planning to completely repeal the inheritance tax by 2025.

Ad Subscribe a Plan for Unlimited Access to Over 85k US Legal Forms for just 8mo. See General Instructions for Iowa Inheritance Tax Return IA 706. If your relation to the person leaving you money is any of the above you wont owe inheritance tax regardless of the size of your inheritance.

Even if no tax is due a return may still be required to be filed. See In re Estate of Heuermann Docket No. Get Access to the Largest Online Library of Legal Forms for Any State.

2021 taxiowagov 60-062 01032022. The estate tax is a tax on a persons assets after death. What is the federal inheritance tax rate for 2020.

That is worse than Iowas top inheritance tax rate of 15. What is the federal inheritance tax rate for 2020. That is worse than Iowas top inheritance tax rate of 15.

That is worse than Iowas top inheritance tax rate of 15. An exemption from Iowa inheritance tax for a qualified plan does not depend on the relationship of the beneficiary to the decedent. For deaths occurring on or after January 1 2025 no.

For more information on the limitations of the inheritance tax clearance see Iowa Administrative Code rule70186122. Iowa Inheritance Tax Rates. For more on beneficiary designation visit this article.

In 2020 federal estate tax generally applies to assets over 1158 million. In 2020 there is an estate.

The Effects Of Taxes On Wealth Inequality In Artificial Chemistry Models Of Economic Activity Plos One

The Effects Of Taxes On Wealth Inequality In Artificial Chemistry Models Of Economic Activity Plos One

Iowa Farmland Rental Rates 1994 2022 Usda Ag Decision Maker

The Effects Of Taxes On Wealth Inequality In Artificial Chemistry Models Of Economic Activity Plos One

Donald Trump Has At Least 1 Billion In Debt More Than Twice The Amount He Suggested

State By State Guide To Taxes On Retirees States And Capitals Funny Retirement Gifts Retirement

The Effects Of Taxes On Wealth Inequality In Artificial Chemistry Models Of Economic Activity Plos One

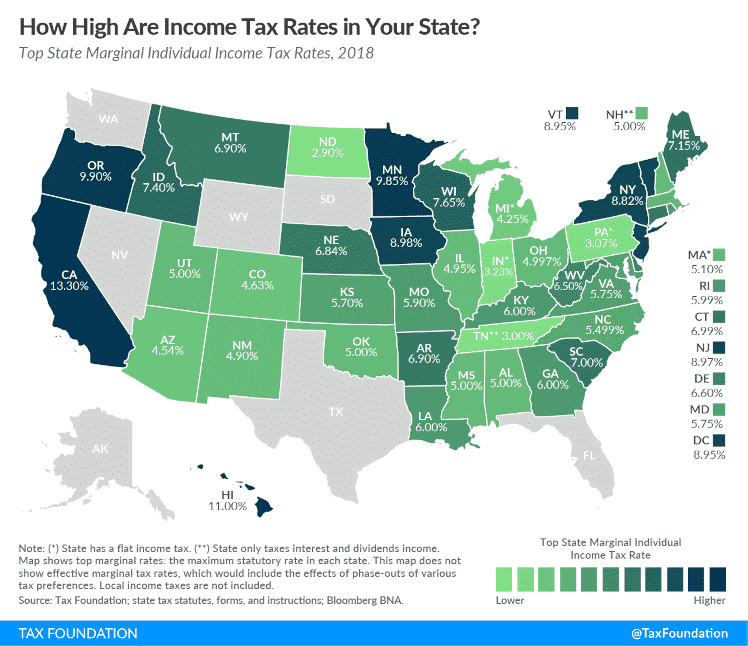

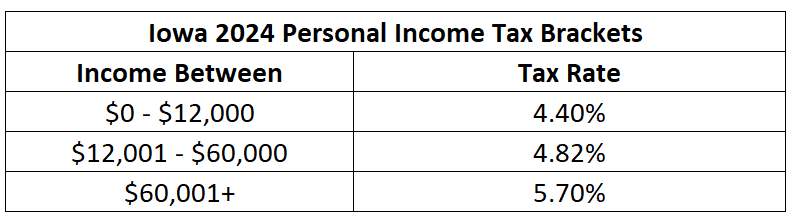

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

The Effects Of Taxes On Wealth Inequality In Artificial Chemistry Models Of Economic Activity Plos One

The Effects Of Taxes On Wealth Inequality In Artificial Chemistry Models Of Economic Activity Plos One

Altered State A Checklist For Change In New York State Empire Center For Public Policy

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax