how to read td ameritrade tax documents

Ad Increased Volatility has Increased Questions. On the screen Lets get your tax info enter TD Ameritrade in the search box.

Td Ameritrade Tax Documents How To Discuss

Open a new account Log-in help Contact us Security settings.

. Select TD Ameritrade under the popular choices then scroll down and click Continue. Questions about tax document from TD Ameritrade. From our Client Login page click the TD Ameritrade button.

Log in to your account and under the Client. Form 1099 OID - Original Issue Discount. This is how you can download or share it.

Get the Answers You Need Online. The developers want you to read and monitor your account at any time of the day. How to read td ameritrade tax documents.

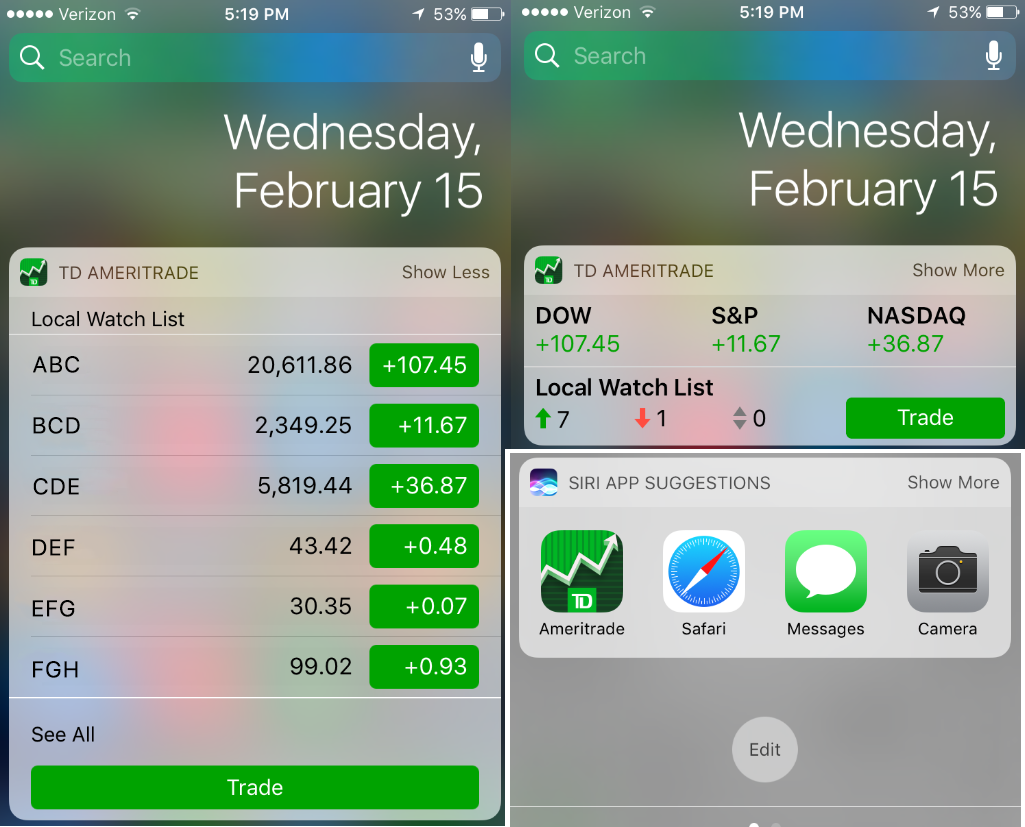

New to TD Ameritrade Recently opened my TD Ameritrade account they said my SSN did not match between what I entered and one of my other credit sources and locked up my account. You need your tax documents for the tax file Right. Starting this tax year TD Ameritrade clients can sign up for alerts via text and push notification.

Ad Increased Volatility has Increased Questions. Then follow these steps to download the tax documents. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation.

Select TD Ameritrade under the popular choices then scroll down and click Continue. After a year of investing and trading its time to report your taxable investment income to the IRS. How to read td ameritrade tax documents Friday June 10 2022 Edit.

Actually yesif were talking about tax document alerts from TD Ameritrade. Click on their logo in the window. The tax on a major purchase however can be added to the table amount so keep those.

We can go ahead and import. Get the Answers You Need Online. To help you do this your brokerage firm will send you.

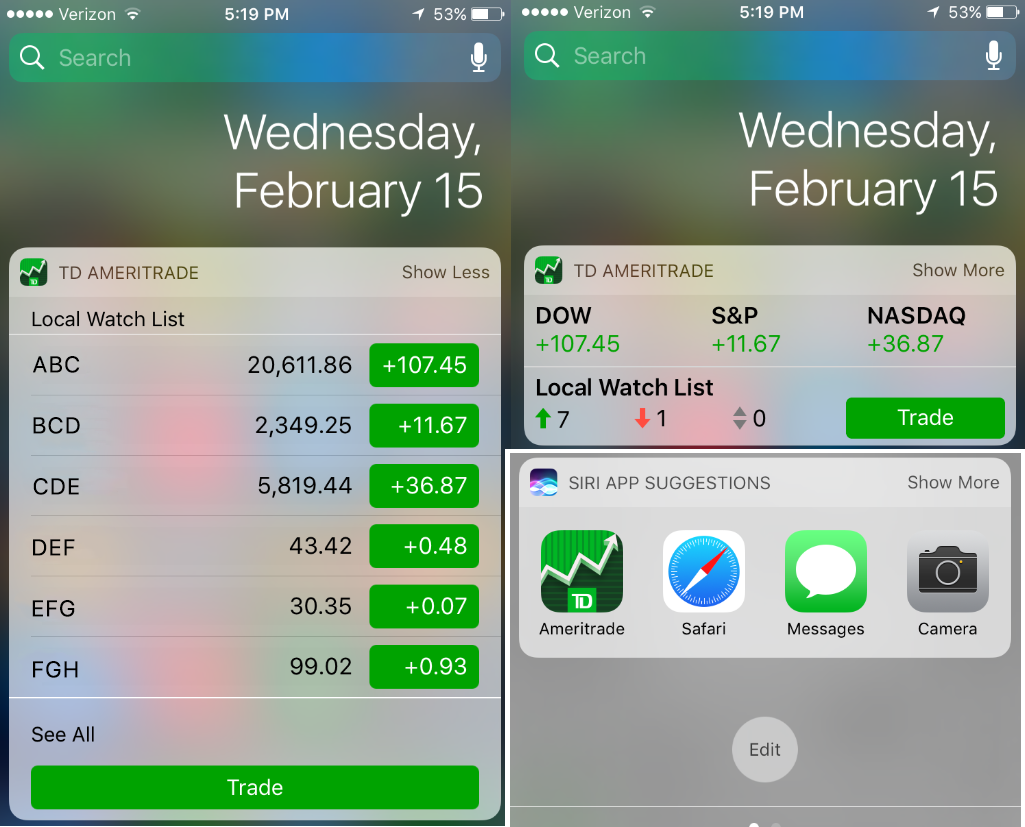

Retrieve your tax documents or. I started stock trading in around August 2020 and bought and sold a couple stocks for a profits of about 15k in both ToS and Robinhood. Dear Customer Because you only have covered transactions - you may report totals from your 1099B form directly on your tax return without reporting each transaction.

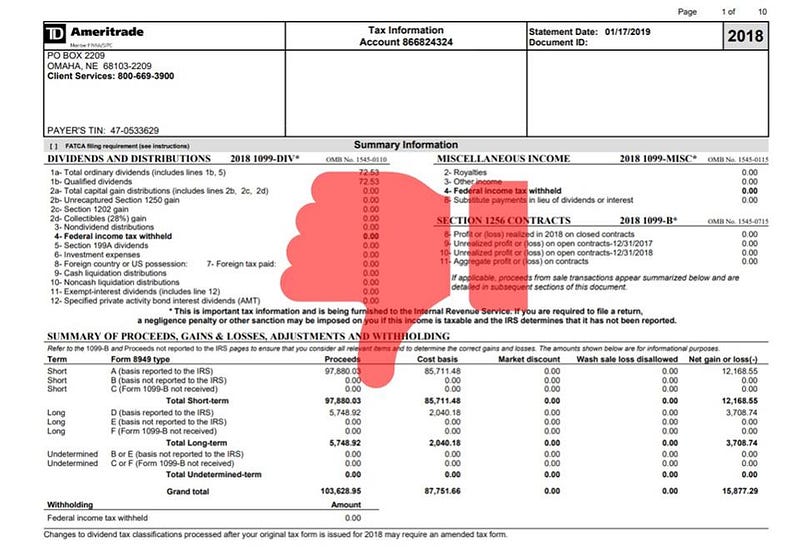

Retrieve your tax documents or statements by navigating to Accounts selecting the. TD Ameritrade will report a dividend as qualified if it has been paid by a US. Get the Answers You Need Online.

If you hold covered securities with tax-exempt original issue discount OID it will now be reported to the IRS on Form 1099-OID. Retrieve your tax documents or statements by navigating to Accounts selecting the account and navigating over to the Docs tab. Please watch the full video.

2 Frequently Asked Futures Questions Td Ameritrade Td Ameritrade Review Is Td Ameritrade Good For. Log in and then click on Documents at the top of the page. From our Client Login page click the TD Ameritrade button.

The TD Ameritrade Mobile app now has up to 7 years of tax documents and 10 years of statements available from your iOS or Android device. Log in and then click on Documents at the top of the. Enter the sign in information on the next screen.

Click the first screenshot below for reference Nice. Then click the Tax Documents button on the left side.

Get Real Time Tax Document Alerts Ticker Tape

1099 Information Guide Pdf Free Download

How To Read Your Brokerage 1099 Tax Form Youtube

Tax Season And More Made Simpler With The Td Amerit Ticker Tape

Are You Considering These 4 Things When Choosing A Crypto Tax Software Cointracker

How To Read Your Brokerage 1099 Tax Form Youtube

What Are Qualified Dividends And Ordinary Dividends Ticker Tape

Tax Season And More Made Simpler With The Td Amerit Ticker Tape

Documents To Bring To Tax Preparer Tax Documents Checklist

Find Your 1099 On Td Ameritrade Website Tutorial Youtube

What Are Qualified Dividends And Ordinary Dividends Ticker Tape

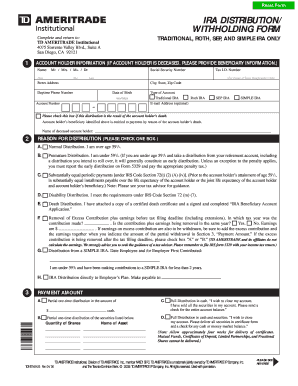

Td Ameritrade Forms Fill Out And Sign Printable Pdf Template Signnow